November Data: Custom Architects Weigh In, New Construction Trends, Contractor Confidence, and Material Price Changes

November saw a bevy of research released by organizations throughout the residential construction industry, including reports from John Burns Research and Consulting, The Farnsworth Group, the National Association of Home Builders, and the Bureau of Labor Statistics. For your ease, we have collected relevant highlights from a number of those reports.

Custom Architects Forecast "Moderate Declines"

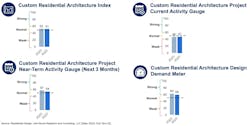

In November, John Burns Research & Consulting released its Q3 US Custom Residential Architecture Index, which gauges current growth, future growth, and demand. The Index uses a common 100-point scale in which, according to the company, “above 50 indicates industry growth” and “below 50 indicates slowing activity.” The overall Index rating for custom residential architecture in Q3 was 51, reflecting “normal” industry sentiment. However, the more granular data shows where things are strongest and weakest.

For instance, year over year, completed projects by custom architects are down 1.8% and average project revenues are down 1.7% while building costs are up 3.3% (largely due to high material and labor costs). Compared to Q2, the index rating for “near-term activity” (defined as the next three months) is down from 57 to 54 but up from 46 to 47 for current activity. The rating for demand has fallen three points from last quarter, from 62 to 59, but remains well above the index’s “normal” rating.

According to the report, “Custom residential architects forecast moderate declines in market conditions."

NAHB Reports on Bathrooms and Porches in New Homes

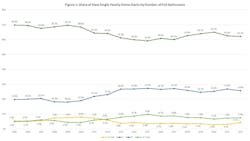

In an analysis of the Census Bureau’s latest Survey of Construction, the National Association of Home Builders found that new single-family homes started in 2022 were more often than not being built with two full bathrooms and a porch (though, not necessarily together).

Sixty-two percent of new homes in 2022 included two full bathrooms, compared to 25.8% that had three and 7.5% that had four or more. The least likely scenario was a home with just one full sized bathroom, continuing a trend since 2012, when it became more likely for a home to have four full bathrooms than just one.

Porches have long since been a staple of new single-family homes, but since 2008 the percentage of new homes with porches has jumped from 60% to 66.4%, reaching its highest share in those 14 years. When looking regionally, porches are exceptionally popular in the East South Central (80%) and Pacific (78%) regions and exceptionally unpopular in the West South Central (45%) region, where the share of new homes with porches is 16% less than the region with the next fewest share, West North Central (61%)

Contractors Report Increased Revenue and Strong but Falling Confidence

The Farnsworth Group’s Q4 Contractor Index, which gauges a number of contractor types—remodelers, mechanical, finishing, exterior, landscaping—on confidence, revenue, and leads, found that while confidence among all its group remains high, there does appear to be some concerns about the market’s future.

“On one hand, confidence amongst the pros continues to soften quarter over quarter, really since last year,” says Grant Farnsworth, president of The Farnsworth Group. “On the other hand, project revenues, project size, backlogs are holding fairly solid.” He adds, “There seems to be this sentiment about concern tomorrow.

Q4 2023 Farnsworth Contractor Index from Grant Farnsworth on Vimeo.

Among all contractor groups studied, a majority are reporting increases in average revenue over the last quarter. Most are also reporting bigger projects. “ Forty-three percent said their average project size actually increased in Q3,” Farnsworth says.

The report’s also showed a softening of lead activity, which includes measurements on quality, volume, and the ability to close. As a result, competition is increasing. “(Contractors) are fighting to compete today more than they had to in 2021 or 2022,” Farnsworth explains. It’s in part a response to cost. “Keep in mind that we have increased budget sensitivity amongst homeowners that is starting to impact contractors needing to compete more. Homeowners are submitting more bids than just to one contractor these days.”

Custom Architects Weigh In on Window and Siding Preferences

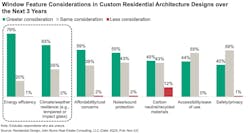

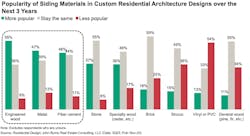

In the second portion of John Burns Research and Consulting’s quarterly Custom Residential Architecture Index, the report includes data regarding window and exterior siding preferences that reveals “energy efficiency” and “meeting client demand for increased sizes/larger expanses” as respondents’ “top window priorities.”

Reagrding windows, over the next three years, 79% of custom architects expect energy efficiency to be a bigger concern than affordability, noise, and safety—which will all still continue to be significant concerns in their own rights. Sixty-five percent expect climate and weather resilience to be similarly important. This may seem a result of a growing demand for sustainability. However, as 12% of custom architects say concern for “carbon neutral/recycled materials” is likely to decrease (the biggest expected decrease of any concern listed in the report) the trend towards energy efficiency may also be in part a result of more stringent codes rather than simply consumer demand.

When it comes to siding, weather resistance (70%) and affordability (67%) are expected to be chief concerns for homeowners over the next three years. During that time, custom architects anticipate engineered wood (55%), metal (47%) and fiber cement (46%) to rise in popularity as a siding material, while more than half (54%) expect “vinyl or PVC” to drop.

Construction Material Prices High but Down

The latest Producer Price Index, released by the Bureau of Labor Statistics, provided several valuable insights into the state of material costs.

Overall construction material prices fell both month over month and year over year in November, which is a welcome sign of improvement. However, prices remain considerably elevated compared to early 2020, when the pandemic (and its complicated mix of factors) first forced prices to skyrocket. Still, in a number of categories the industry is seeing material price relief.

Images: U.S. Bureau of Labor Statistics, Federal Reserve Bank of St. Louis

Prices for softwood lumber, for instance, saw a 13-point month-over-month decrease on the index, continuing a trend of relative decline since March 2022—during which the index has plummeted 300 points. Steel mill products are also currently experiencing a sustained decline in price, though this decline began only in May 2023.

Gypsum also experienced a year-over-year price decline in November, and has indeed been experiencing price declines for much of the year. However, those declines (down 13 points since March 2023) have been slight—especially compared to the climb in price between October 2020 and March 2023, during which time its PPI increased 125 points.

While many major product categories appear to be in some state of price decline, ready-mix concrete is one for which prices continue to climb. In November, the category’s PPI hit its highest point since 1965, when the index was created.