Guest Column: External Forces

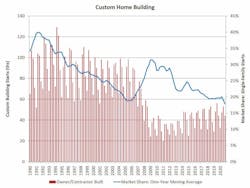

The custom building market was generally flat in a tumultuous 2020. According to National Association of Home Builders’ (NAHB) analysis of Census data, there were 176,000 custom-home construction starts last year. This was effectively unchanged from the 177,000 starts in 2019.

However, due to the expansion of the rest of the single-family construction sector, the market share for this kind of housing posted a decline. At the end of 2019, and on a one-year moving average, custom homes made up approximately 19.7% of single-family construction. By the end of 2020, it had fallen to 17.8%.

The outlook for custom home building faces crosswinds. On the positive side, the geographic shift of housing demand to lower-density, lower-cost markets provides additional growth opportunities. Custom building tends to involve larger, more expensive homes in relatively low-density markets. Changes in housing preferences due to the COVID-19 crisis, combined with the additional flexibility of location made possible by telecommuting, are lifting demand for custom homes.

Additionally, over the last three decades, we’ve seen that the custom market tends to grow when the stock market is doing well. Custom home building buyers are generally older and wealthier, and their down payment for a home purchase is more often connected to financial investments. So, when the stock market appreciates, the total budget for custom home building tends to increase. A consequence of 2020 was a remarkable rebound and expansion for financial markets.

On the other hand, higher building material costs and a shortage of lots tend to crowd out custom building. More than two-thirds of builders report low lot supplies. And as the residential construction industry expanded and served as a relative bright spot for the economy in 2020, building material costs climbed. This was especially true for softwood lumber, which saw price increases of almost 200% from mid-April 2020 to mid-March 2021. Additionally, 90% of builders in an NAHB survey said they were facing delays for the arrival of appliances and other materials, which extends construction times and increases costs. While some of these headwinds may abate somewhat in 2021, a shortage of materials and lots will hold back custom home building.

Interest rates are a final factor to consider. The NAHB economic forecast indicates mortgage rates will rise above 3% in 2021 and will average near 4% in 2022. A 4% 30-year fixed-rate mortgage is likely high enough to reduce effective housing demand, similar to the 4.9% rate effect that occurred in the second half of 2019, when home prices were lower. Still, historical data indicates that slowing housing demand due to higher interest rates has a larger impact on spec-built homes than on custom. This shift in market share can be seen in past data where the custom market held an elevated share of construction from 2008 to 2012, when custom builds made up almost 29% of single-family construction.

Putting this all together, the growing household net worth of soon-to-retire Baby Boomers and Gen Xers in their prime earning years will provide a solid foundation for custom home building growth. While higher interest rates and construction costs will negatively affect housing demand, the underlying demographic shift in the geography of home construction means custom building’s market share will rise in the years ahead.

Robert Dietz is chief economist and SVP for economics and housing policy at the National Association of Home Builders.