Smart Home Tech for All

In December 2021, Home Innovation Research Labs polled custom builders about changes to their business practices due to the pandemic, asking what they viewed as temporary, and what they considered a permanent part of their home building business going forward. While issues surrounding labor and materials took the forefront, and there was a notable boost in practices related to the outdoor living boom, there was another change reported that was a bit more unexpected—a wider embrace of “smart” home technologies. In their explanations, many builders said they had been caught off-guard by the expansion of home tech and were scrambling to keep up with the expectations of a new wave of tech-savvy buyers. I gave an overview of these study findings in my presentation to the Leading Suppliers Council at the 2022 International Builders’ Show.

Ultimately, it’s not that much of a surprise to understand the growing appeal of smart home technologies. As people began spending more time at home during the pandemic, for work, school, and entertainment, their technology needs and expectations shifted. Since the inception of home automation more than 40 years ago, home electronics have evolved from a mere curiosity for the small “ahead-of-the-curve” segment of luxury homebuyers, to our current technology reality. In the 1980s, Smart House was established here at Home Innovation Research Labs (see, NAHB Research Center) with the goal of bringing the disparate wiring technologies and communications protocols onto a single platform to speed up adoption. Even then, it would have been hard to imagine the direction home technologies would have taken.

Recently, in collaboration with Professional Builder and Custom Builder magazines, Home Innovation included several questions in our Omnibus Survey of home builders to “take the pulse” of home electronics in new homes. The overall results are illustrated in the graphs below.

This study found that the most popular home technology offering is Cable/Wiring and Wi-Fi Infrastructure, offered as a standard feature by three-quarters of all custom home builders in the survey, and as an option by almost all others. Connected Programmable Thermostats were also offered by nearly all custom builders as a standard feature or upgrade, followed by App-Controlled Garage Doors and Learning Thermostats (such as Nest). Compared to all new home builders, custom builders were more likely to offer smart home options in every category.

Looking into how builders responded by the price-point of home they build, builders of Luxury homes were more likely to offer home electronics than Starter home builders across all technology types—but in some cases, not by much more. This difference was most prominent with traditional home electronics such as Monitored Security, Multi-Room Audio Systems, Home Theaters, and Automated Lighting Control. However, very little difference between builders of Luxury and Starter homes was observed for Cable or Wi-Fi Infrastructure, Unmonitored Security Systems, and Communicating Programmable Thermostats.

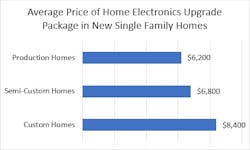

When offering home electronics as upgrades, builders tended to offer technologies as individual technology upgrades instead of offering them through upgrade packages. Production builders, however, were much more likely to offer technologies in packages than were Custom builders, but less likely to offer them as individual upgrades.

In terms of what homeowners paid, builders surveyed said $7,100 was about the average cost for an upgrade package. And when asked who installed most of the home technologies, the most common type of contractor reported was Electrician, followed by Security Contractor and Systems Integrator.

The smart home industry’s original vision of a single home automation platform installed by a single trade — i.e., a Systems Integrator — is now pretty common and making progress. However, the typical builder reported using two or three different contractors for installing smart home devices, so a “piecemeal” approach to home technologies is still more prevalent. This was true among Custom and Luxury home builders in the survey.

For decades, Home Innovation’s marketing research team has been helping building product manufacturers and service suppliers gain a deeper insight into changes in the market landscape and understand who and what is driving change. From our state-of-the-art observational research facility, well-appointed focus group suites, to our survey panel of construction pros, our research solutions have been designed specifically to serve the needs of the building industry. Contact us to learn how we can help you stay informed on your markets.

Ed Hudson is the Director of Market Research for Home Innovation Research Labs.