October's Data From Around the Industry

The amount of data is increasing exponentially. As a result, many industries, including residential construction and housing at-large, are benefitting from a glut of research as well as on-going data tracking and analysis that can help those within better understand and furthermore operate successful, impactful businesses. If there is a downside, it’s that the quantity of available data has become so much that it can be hard to keep track of it all.

That being said, we at Custom Builder would like to, moving forward, make it easier for our readers to take in more by aggregating and simplifying some of the new and relevant research, data and analysis released every month.

In October, we saw reports from the Joint Center for Housing Studies at Harvard University (JCHS), HOP Energy, the National Association of Home Builders, and John Burns Research and Consulting.

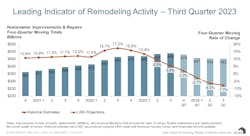

Remodeling Spending Expected to Fall in 2024

Researchers at Harvard's JCHS anticipate remodeling spending to fall in 2024 relative to 2023's levels, according to its latest Leading Indicator of Remodeling Activity (LIRA) report. The decrease is expected to be particularly steep in the latter half of next year, with a projected year-over-year decline of 7.7% in Q4 2024.

“The ongoing weakness in the housing market caused by high interest rates and low supply of existing homes is expected to weigh on remodeling activity next year,” says Carlos Martín, Project Director of the Remodeling Futures Program at the Center. “Homeowner concerns about the health and direction of the broader economy may also dampen plans for remodeling projects.”

Homeowners Are Spending More on Energy Bills and Precautions

For its recent "Energy Bill Costs and Home Temperature Preferences in 2023" report, HOP Energy surveyed 900 people nationwide to find that, one, energy bills are increasing for a majority of Americans, and two, people are looking for ways to cut costs.

Some of the ways homeowners are keeping utility costs lower are passive, like keeping ACs set lower or opening windows in the summer. But in the winter, when passive solutions are less available, HOP Energy’s report shows that at least a quarter of Americans are anticipating spending money on weatherization projects like heating system inspections (50%), door sweep installations (47%), and weather stripping (39%).

Private Wells, Individual Septic Systems, and Central AC Systems on the Rise

In new tabulations of Survey of Construction data from the US Census Bureau, NAHB Economists Jing Fu and Fan-Yu Kuo showed in recent blog posts that new homes are being built with more private wells, individual septic systems, and central AC systems than in recent years.

Juo’s report also showed the current prevalence of air or ground heat pumps as well as fuel sources for heating systems. As it relates to heat pumps, there appears to be a strong preference for the technology in southeastern states, especially along the Atlantic Coast. And as it relates to primary heating fuels, natural gas and electricity are the overwhelming go-tos; though, their usage varies by region.

For example, around three-quarters of the new homes started in 2022 in the Middle Atlantic region rely on natural gas while a little over 80% of the new homes in the South Atlantic region rely on electricity.

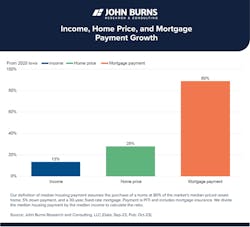

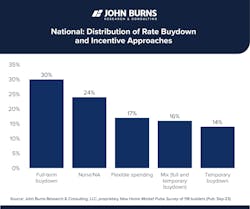

Builders Are Selling Via Rate Buydowns

Housing affordability is an increasingly distressing problem for the housing industry. However, despite that, new home sales have stayed strong. A recent survey from John Burns Research and Consulting suggests that those strong sales may, in at least some part, may be the result of widespread rate buydowns—which the report describes as when “a builder prepays part of the home buyer’s interest to buy down the mortgage rate. In a survey of more than 100 production home builders, 60% admitted to using rate buydowns as a vehicle for sales.

While the process is not new, John Burns’ report does describe how the process has evolved post-pandemic. Notably, the report explains how builders are committing longer-term buydowns, reading, “Builders tell us temporary rate buydowns (for the first 1–3 years of the mortgage) do not solve the affordability problem, and most are committing to a 30-year rate buydown, particularly for first-time buyers.”