Top Problems Faced by Builders in 2022

Builders faced a litany of widespread, deeply impactful challenges in 2022, but none was more significant than the price and availability of building materials.

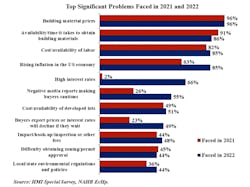

That was the conclusion of newly released survey results from the National Association of Builders/Wells Fargo Housing Market Index, which in January asked builders to identify last year’s biggest pain points. The price of building materials (96%) as well as their availability and the time in which it took to obtain said materials (91%) was a pain felt nearly unanimously among respondents—more widespread than the cost and availability of labor and more prevalent than the impact of inflation (both of which, from 2021 to 2022, decreased in significance among builders).

While building materials prices did decline overall during the latter half of 2022 and the price increase for the year total was 10.6 percentage points below 2021’s, the impact of shifting material prices and availability remained chief from year to year.

Big Changes From 2021 to 2022

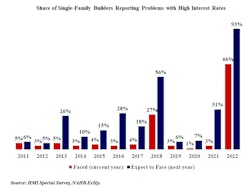

While some problems facing builders have carried over from 2021 to 2022, others were unique to the year. High interest rates, for instance, were a concern for about 2% of builders in 2021. But in 2022, two-thirds of builders agreed that interest rates were a “significant problem.” Nearly all builders (93%) expect the problem to continue through 2023.

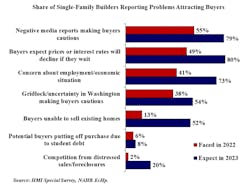

Waning consumer confidence overall also became a significant problem last year. Fifty-five percent of builders in 2022 described “negative media reports making buyers cautious” as an issue (compared to 26% in 2021) and 49% said that “buyers expect prices or interest rates will decline if they wait” (compared to 23% in 2021).

When asked specifically about problems in attracting buyers—both as a problem in 2022 and an expectation for 2023—builders' chief concerns were consumers waiting for interest rates and prices to change, and negative media reports.